Can LLMs Really Build Robust Trading Strategies? I Put Gemini and Claude to the Test.

Which AI Delivered a 2.31 Profit Factor? See the Equity Curve, the Code, and the One Change That Made It Work.

These questions hit my inbox constantly:

ChatGPT or Claude?

Gemini or DeepSeek?

Can any of these LLMs actually create robust strategies?

Which one delivers the best results?

So I decided to test an idea you can replicate yourself.

In fact, I encourage you to try it the results might surprise you.

The Idea

Every week, I publish a trading idea I've backtested with historical data and share the code so you can modify, improve, and discuss it in our community chat.

This week's concept was beautifully simple:

Buy when: volatility spike + price at bottom

Sell when: price recovers

I took this basic idea to Gemini 2.5 Pro to see what it could create.

The prompt I used (which you'll find at the end of this article) was based on a model I've shared in this previous article below:

What Gemini Delivered (And Why It Failed)

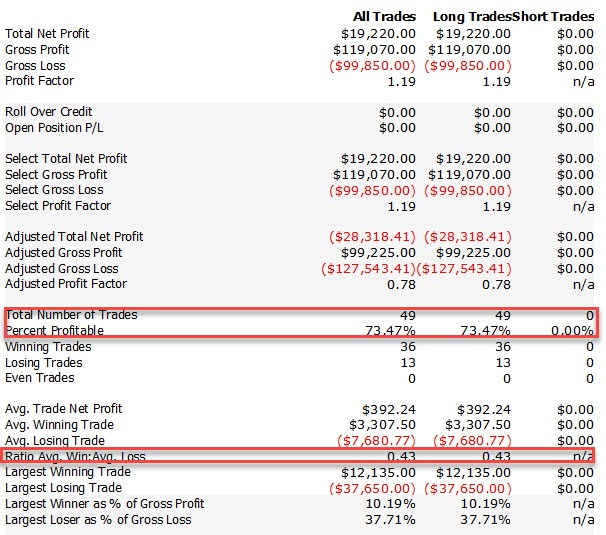

The initial results looked promising on the surface:

Win ratio: 73%

But only 49 trades over 18 years

Average win/loss ratio: a measly 0.43

And the equity curve…

The equity curve told the real story: not tradable.

Here's what most traders get wrong:

They expect a single conversation with an LLM to produce a working strategy.

That's like expecting to find gold on your first swing of the pickaxe.

The Hidden Gem Approach

What you need instead is a conversation. A debate.

You need to:

Challenge the LLM's assumptions

Point out obvious flaws

Ask for alternatives

Keep pushing back

That back-and-forth dialogue is where the hidden gems emerge.

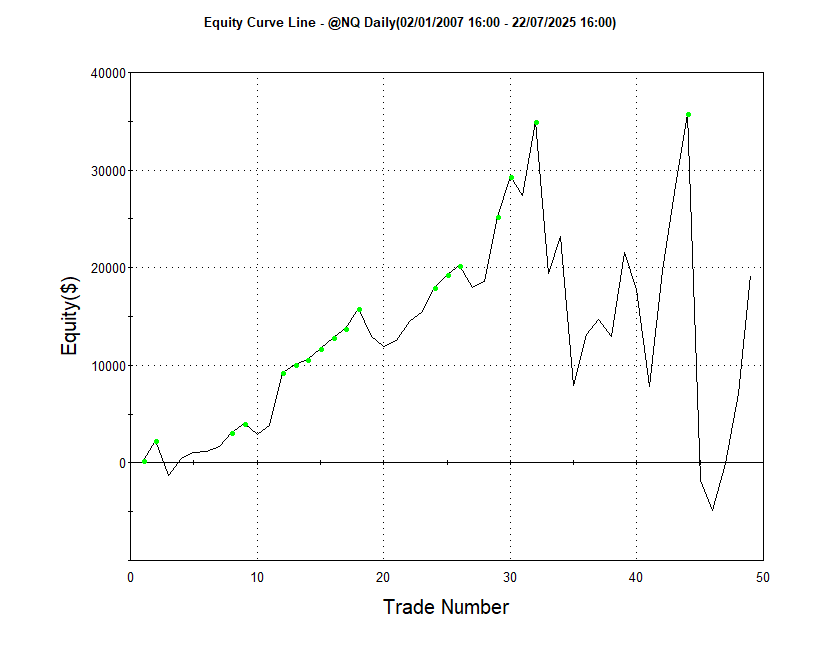

So I shared the disappointing equity curve with Gemini, highlighted the problems, and specifically questioned the tiny number of trades across 18 years.

Gemini's response was brilliant in its simplicity: change just one parameter in one variable.

Instead of using factor 2 as the trigger, use factor 1.

That single adjustment transformed everything.

The new results were wild:

Dramatically improved equity curve

No optimization whatsoever

Clear potential for further development

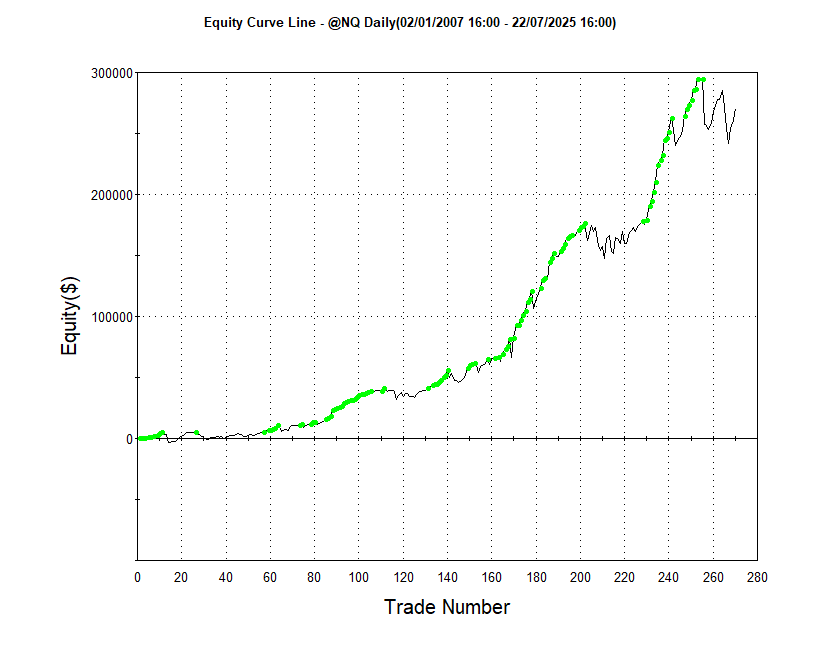

And here’s the equity curve…

I want to emphasize:

This wasn't curve-fitting or over-optimization.

One parameter change in one variable revealed something worth pursuing.

And how do you improve a trading strategy without overfitting?

That’s exactly what I’m going to show you next…

The Improvement

Here's where I see LLM enthusiasts go completely wrong.

They ask the same AI to "improve the strategy," and it returns the original idea buried under 7 new filters and 5 optimization suggestions.

You know what happens next…

A hopelessly overfitted system.

So instead of continuing with Gemini, I used a technique I've shared in the article below:

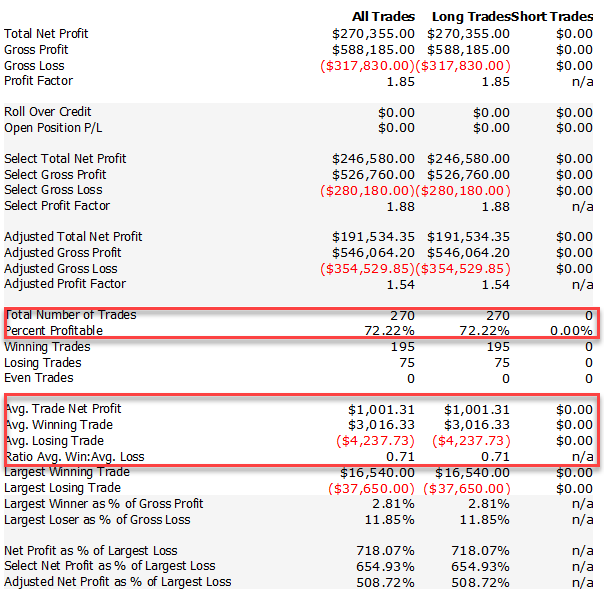

I asked Claude Opus 4 to review Gemini's strategy and propose improvements.

Long story short…

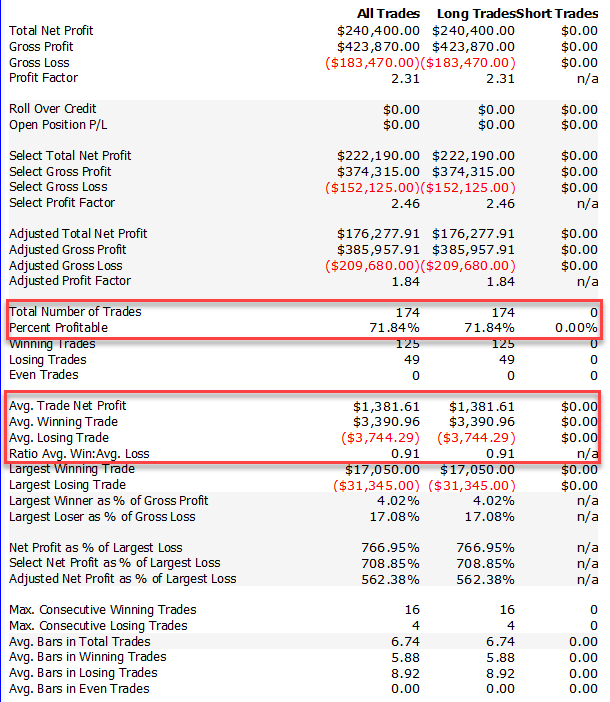

Claude's refinements (before any optimizations) delivered:

As you can see:

Profit Factor jumped from 1.85 to 2.31

Win rate remained stable

Average trade net profit increased from $1,001 to $1,381

Average win/loss ratio improved from 0.71 to 0.91

So yes, you can create strategies using LLMs. But not the lazy way.

Not with prompts like "create me a robust strategy that makes money."

Instead, treat it like collaborating with another trader:

Question assumptions

Point out errors

Ask for feedback

Work as a team

What’s Next?

You might be thinking,

"this sounds too good to be true. How do you know this strategy will actually work in live trading?"

You're absolutely right to be skeptical.

I haven't run comprehensive robustness tests yet…

Only a basic parameter stabilization analysis during optimization.

This involves checking whether changing a moving average from 50 to 49 drastically alters results or keeps them relatively stable.

The strategy passed this preliminary test, but there's substantial work ahead: walk-forward analysis, Monte Carlo simulations, variance testing, and more.

This isn't a finished product, it's a promising foundation that demonstrates the potential of collaborative AI development.

What This Means for Your Trading

The real lesson isn't about which LLM is "best."

It's about approach.

Most traders treat AI like a magic wand: ask once, get disappointed, give up.

The successful approach treats AI like a knowledgeable colleague who needs guidance, pushes back on bad ideas, and improves through iteration.

This dynamic of conversing between different AIs has been the most effective method I've found for developing solid trading ideas with real trading potential.

The Code Behind the Results

Since you're probably curious about the actual implementations…

I'll share both versions:

The original Gemini code and Claude's improved version, plus the exact prompt I used for Claude's review.