The 1 AI Prompt I Use to Generate 20 Trading Ideas in Seconds

Built on first principles, structured like a quant, and simple enough to test today

My kids love bedtime stories.

Like most kids.

But they’re not into fairy tales or superheroes.

They’re obsessed with one thing:

“Dad, can you tell a witch story? A mean witch, okay?”

Every night. Same request.

So I lie next to their bed and say,

“Alright, buddies. A mean witch story it is.”

Now, I don’t know about you…

But coming up with original witch plots every single night (for let’s say 4 years?) gets a little tricky.

What I usually do is keep the core story structure the same:

A witch lives in the forest…

She leaves her hut to do something evil…

And then I swap the context:

She goes to the lake and finds a…

She visits the city and runs into a…

She sneaks out at night and stumbles upon a…

You get the idea.

The core stays the same, but I keep the surroundings fresh.

And that brings me to today’s post

Because building systematic trading strategies works a lot like telling witch stories.

You start with one core idea…

RSI, volume spikes, gaps, seasonality…

But after 3 or 4 backtests, you feel like you’ve already explored everything.

You hit that creative wall.

Since AI’s already part of my workflow in almost every corner of life, I figured…

Could it work for trading ideas too?

I wasn’t looking for ready-made strategies.

I just wanted ideas. Something fresh. Out-of-the-box.

But simple enough that I could test quickly.

Because the worst feeling is spending two hours coding…

Only to realize the idea was garbage from the start.

So, I built a system.

A simple AI prompt that helps me generate 20 original, testable trading ideas from just one concept.

Ideas that are:

Grounded in first principles

Structured like a quant would think

But creative like an artist would explore

Starting this week…

I’m testing a new format for The Rogue Quant Newsletter:

Two posts per week.

One deep-dive strategy post (with full backtest + code) every Sunday

One AI-powered prompt that solves a specific step in the trading system development process.

These aren’t generic prompts.

They’re prompts I’ve tested, refined, and personally use in my process to research, test, and validate systematic trading systems.

I’m also opening a dedicated space in the Substack chat feature (for paid subscribers) where we can swap ideas, tweak the prompts together, and improve them as a group.

Win-win.

If you're already a paid subscriber, consider this a bonus you weren’t expecting.

If you're not yet, keep reading, maybe this will be the one that convinces you :)

In today’s post, you’ll learn:

How to use first principles thinking to generate original trading strategies

The exact prompt I use to go from 1 concept → 20 testable ideas

A live example of the prompt using the RSI as the core concept

Let’s dive in.

What is this idea prompt generator all about?

I call it:

The AlphaMiner Generator

(but you can call it your “Witch Story Engine” if that helps)

Here’s the idea:

You feed ChatGPT just one trading concept like…

RSI, gaps, VWAP, mean reversion, whatever…

And it gives you 20 different strategy ideas based on that concept.

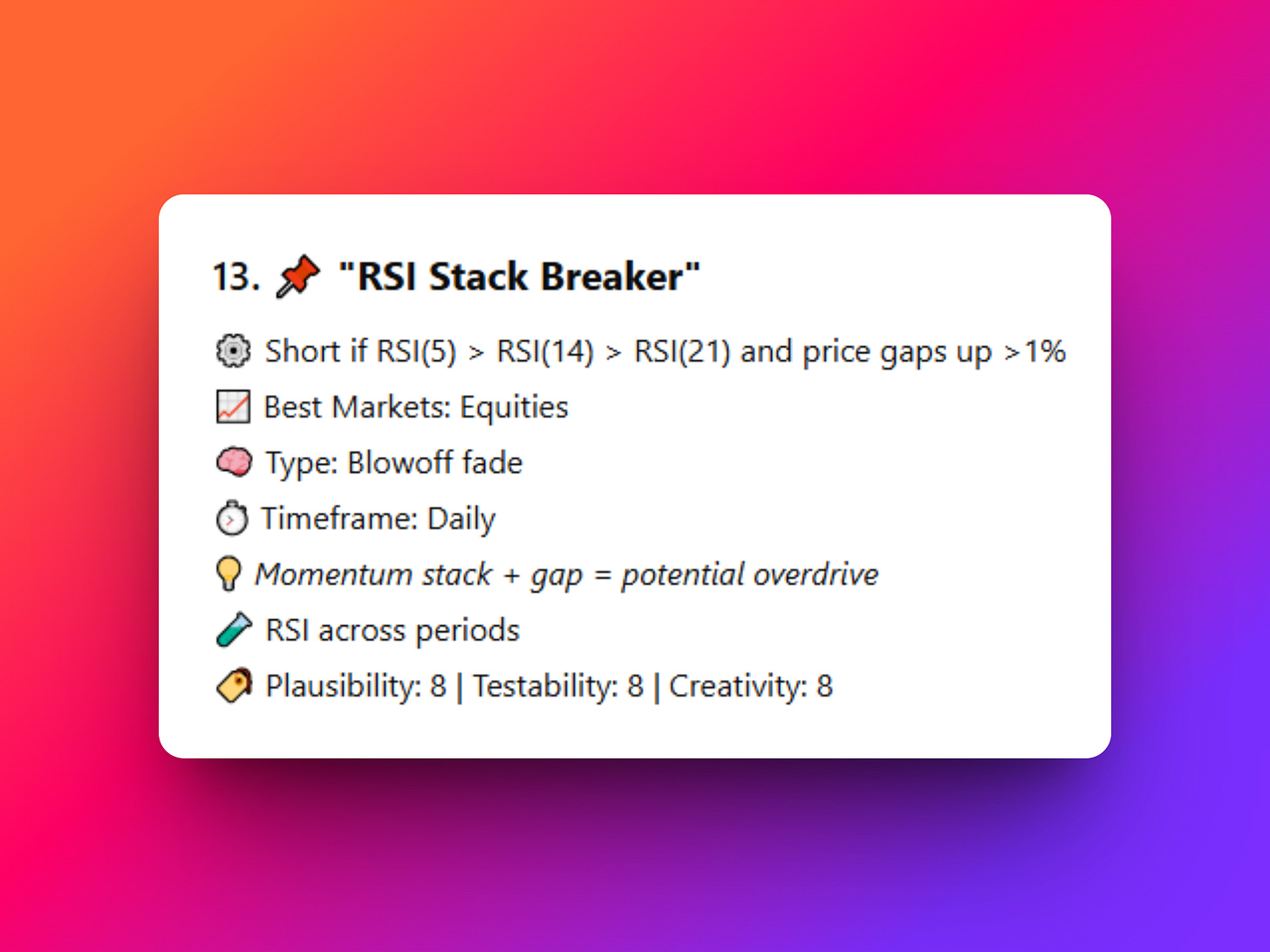

Each one comes with:

A name (so you don’t have to call it “Strategy 4b” anymore)

A clear setup logic in 1-2 sentences (in plain English)

Suggested markets and timeframe to trade

A quick note on why it might work

And of course, a self-rating on plausibility, testability, and creativity :)

But what makes this prompt actually good is how it thinks.

It doesn’t just remix what’s already out there (ok, sometimes it does)

It uses something called…

First Principles Thinking.

Let me explain real quick:

First Principles is basically what you do when nothing’s working and you throw away the playbook.

You stop asking,

“What strategy should I copy?”

And instead ask,

“What does RSI really measure?”

“Why do traders react that way?”

“What happens when that breaks?”

It’s how physicists think.

It’s how good quants think.

It’s how I try to think when I'm not overwhelmed by coffee and too many tabs open.

So instead of:

RSI < 30 = Buy

You might get:

RSI < 35 on assets that made a 10-day low + next candle has higher close = Buy

Simple. Clear. Testable.

I’ll show you why this small shift in idea generation can save you weeks of wasted time.

Why it matters

Let’s be honest:

The hardest part isn’t testing a strategy.

The hardest part is finding a good idea to test in the first place.

Most traders run into the same 3 problems:

They recycle the same tired setups (hello again, RSI < 30).

They overcomplicate everything (12 filters, 6 indicators, zero edge).

They burn hours coding something that didn’t deserve to exist in the first place.

I’ve done all three.

More than once.

That’s why I built this prompt.

It’s not designed to give you finished systems.

It’s not designed to give you finished systems.

It’s not designed to give you finished systems.

Yes, I’m saying it three times so you know what to expect…

It’s designed to give you high-quality raw material.

Ideas you can actually test.

Ideas that make logical sense (well, at least for the LLM)

Ideas you probably wouldn’t have thought of on your own but can totally validate in Excel, EasyLanguage, or Python in under 30 minutes.

It removes friction.

It saves time.

And most importantly, it helps you avoid the worst trap of all…

Sitting in front of your charts thinking,

“Maybe I’ll just test RSI < 30 again… but with a twist.”

Let’s not.

Let’s use this instead…

How to use it

You’ve got two options here:

Be fancy and customize the prompt with your favorite platform, timeframe, or data type.

Or just copy, paste, and let the machine think for you.

I’ll show you the full prompt in just a second, but first, let me share a few results I got while running some examples for this article…

Just to remember…

It’s not designed to give you finished systems.

In my example, I used RSI as the concept.

It gave me 20 ideas.

Out of those 20, I picked 8 that felt worth testing.

And from those 8, one turned into this...

Not too bad for a raw idea.

All I did was take the original setup and tweak one parameter.

Of course, this was just a quick example.

I didn’t validate anything.

No Monte Carlo. No walk-forward. No variance testing.

But that’s the whole point.

It’s a starting point to uncover insights that help you piece together the bigger puzzle.

And in my experience, every winning trading system starts with one simple idea worth testing.

Alright, now let’s get to the good part…

The full prompt.