I Asked 6 LLMs for Better Exit Strategies.

Turns out ChatGPT, Claude, and friends have better ideas than your “2x ATR. Full prompt included...

You start writing a trading strategy.

The entry? Solid. Sharp. Thought-out.

The exit?

Let me guess…

Fixed dollar profit target?

A stop based on some ATR multiple?

Maybe a hard-coded dollar loss?

Or the classic:

"Just close it after 7 bars… I guess?"

Same old, same old.

What if that’s your weakest link?

Stop exiting like everyone else does.

We obsess over entries.

We optimize filters.

We tweak position sizing.

But when it comes to exits?

Most traders use the same old cliché: a 2x ATR stop or a trailing based on some moving average.

And here’s the thing…

That might be the worst part of their system…

Why exits matter more than you think

Every trader has that moment:

You enter a trade. It moves in your favor.

But you exit too early… and watch it keep running.

Or worse — you hold too long, give everything back, and end up red.

Exits don’t just affect profit.

They affect psychology.

They shape how you feel about your system.

Whether you trust it. Whether you follow it.

Whether you stay in the game long enough to win.

And yet — most traders treat exits as an afterthought.

You wouldn’t build a plane with a flawless engine but no landing gear.

So why build a strategy with a great entry… but no plan for the exit?

What if exits weren’t just “stop or target”?

Most exit logic falls into two lazy categories:

Stop Loss + Take Profit (set-and-forget)

Or “when it feels right” (aka: panic, regret, or greed)

But exits can be so much more.

They can adapt.

They can trail intelligently.

They can scale out.

They can respond to volatility, structure, context… even price behavior after entry.

The problem?

Most traders never explore those options…

Not because they’re lazy.

But because they don’t know what else is possible.

That’s where today’s AI prompt comes in.

It’s built to open your mind, spark ideas you’ve never considered,

and give you concrete, testable ways to manage exits like a pro (or at least less average)

But first, don’t skip the setup

The magic of a great prompt isn’t in the words.

It’s in the context you give the machine.

That’s why this one starts with a simple rule:

Don’t generate exits until you understand the trader.

It asks a few strategic questions first about:

The market(s) you trade

Your timeframe and style

How you typically enter trades

The platform you use for backtesting

Why?

Because a brilliant exit that only works in Forex intraday but you trade weekly futures on TradeStation is… useless.

You don’t need any exit.

You need the right exit for you

One that fits your style, your instruments, your constraints.

Once that’s clear…

Then we open the floodgates…

What the prompt gives you (once you’re ready for it)

After collecting the essentials, the prompt shifts into high gear.

It generates at least five exit strategies — each one designed to be:

Creative (not the same old ATR * 1.5)

Logical (grounded in market behavior)

Implementable (no fantasy setups that can’t be coded)

Tailored to your context

And it doesn’t just spit out bullet points.

Each exit idea comes fully loaded with:

A descriptive name

So you stop calling it “exit_v3_FINAL” in your code.Clear rules

Indicators, parameters, triggers — explained step-by-step.Why it might work

The logic behind the exit, based on your trading style and market.Pros and cons

No BS. What you gain — and what you risk — with each one.Adaptation tips

How to tweak the logic or reframe it for different conditions.Best fit

What kind of market regime or asset this exit might shine in.

This is where the prompt earns its keep.

It doesn’t try to be clever for the sake of being clever.

It tries to make you better by pushing you out of “standard exit” autopilot…

And into a space where edge lives…

Ready to try it?

Before I hand you the full prompt...

Let me show you what happened after I ran it through some of the top AI models out there…

Including…

ChatGPT, Claude, Gemini, DeepSeek, Manus, and Grok.

I gave each of them the exact same context.

Same questions.

Same strategy.

Same rules.

Their job?

Deliver 5 creative, implementable, context-aware exit strategies.

Not generic junk. Not “ATR x 1.5”

I wanted smart, surprising, and code-worthy.

Some models delivered.

Some... phoned it in.

Let’s break it down 👇

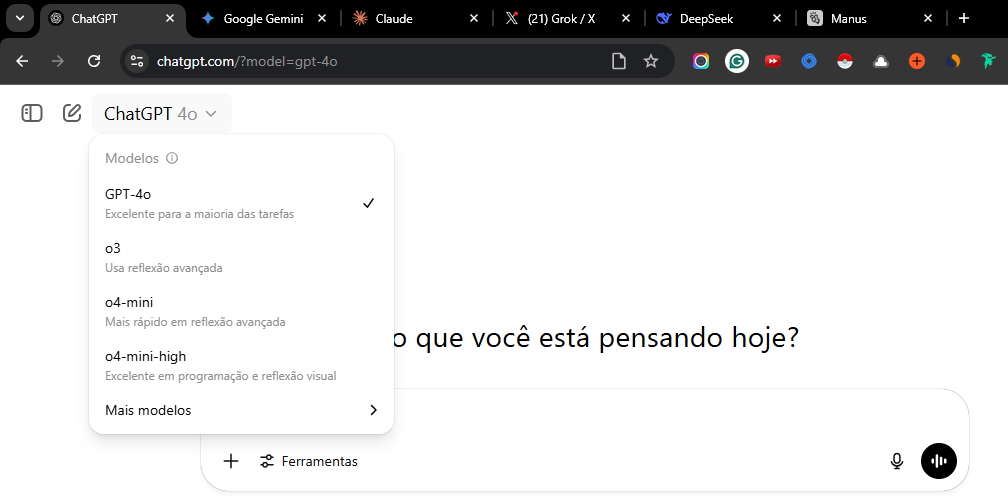

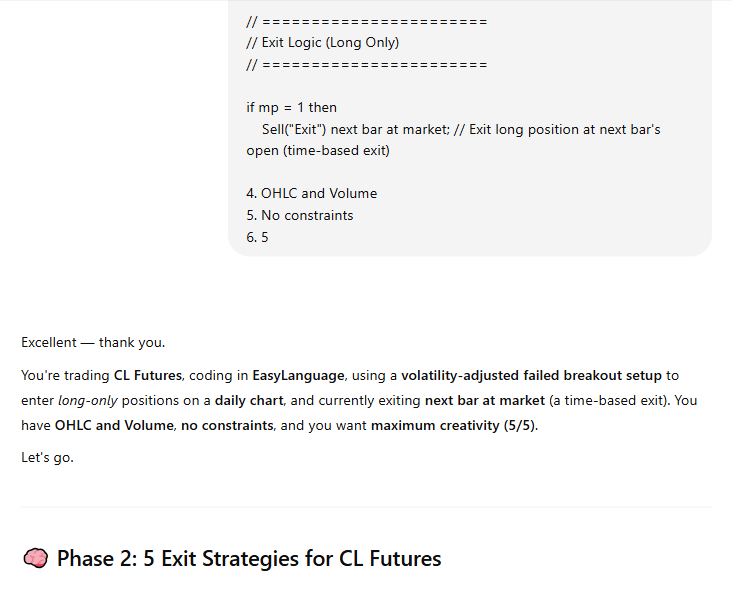

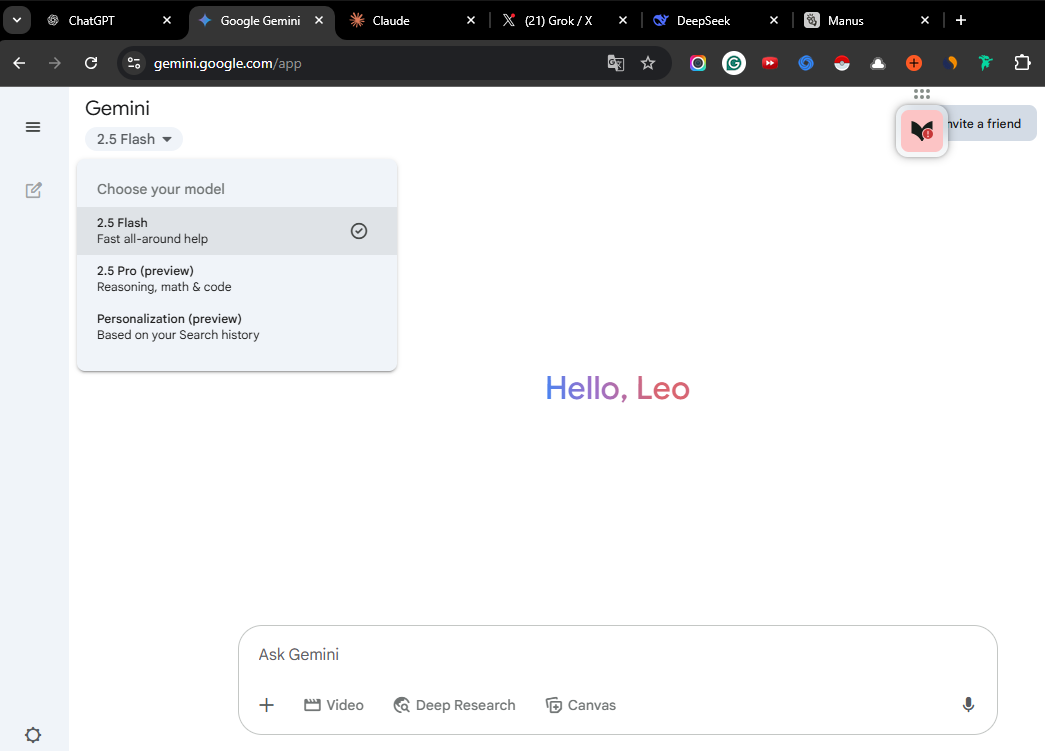

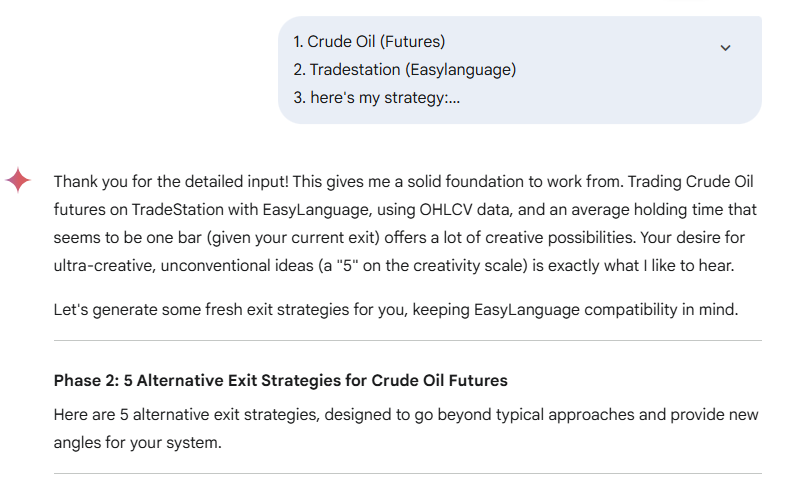

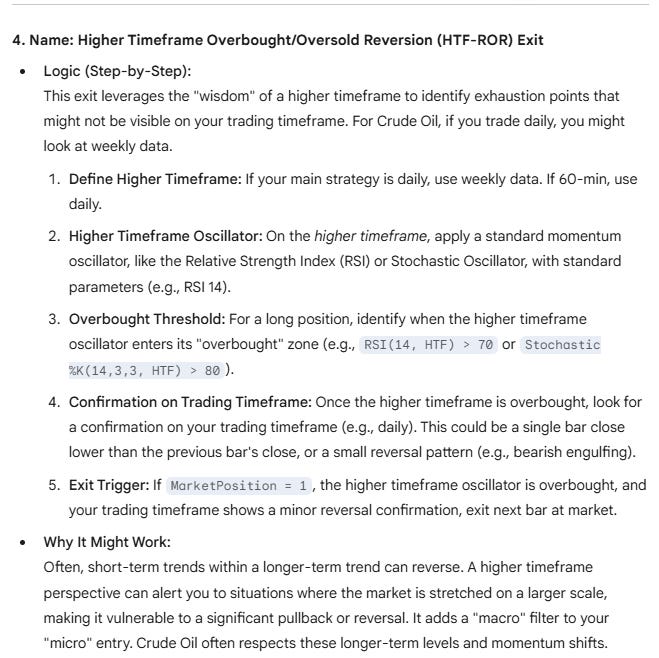

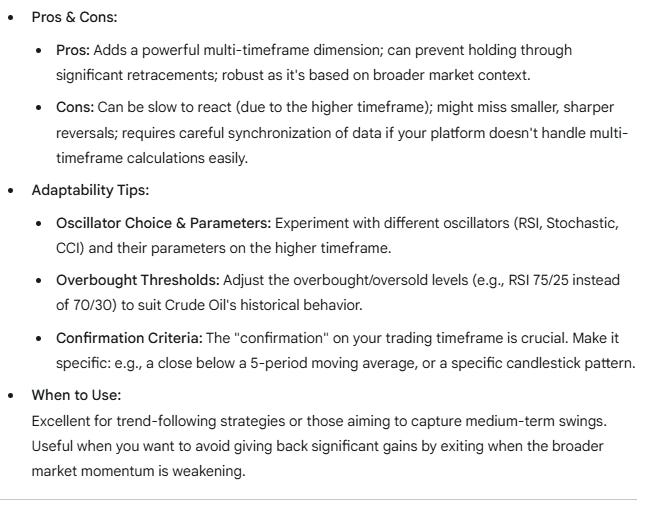

ChatGPT

For ChatGPT I used the GPT-4o model.

Kicked things off strong.

It summarized my inputs nicely and gave me 5 coherent exit ideas…

The prompt I liked the most was this…

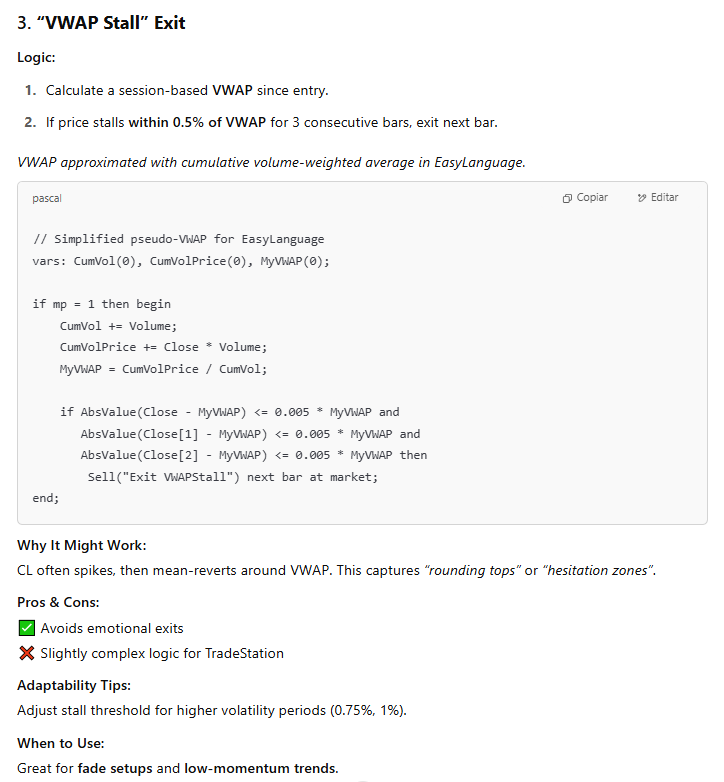

Gemini

For Gemini I used the 2.5 Flash model…

Gemini was fast and clear.

But the output felt… safe.

The most interesting answer for me was this…

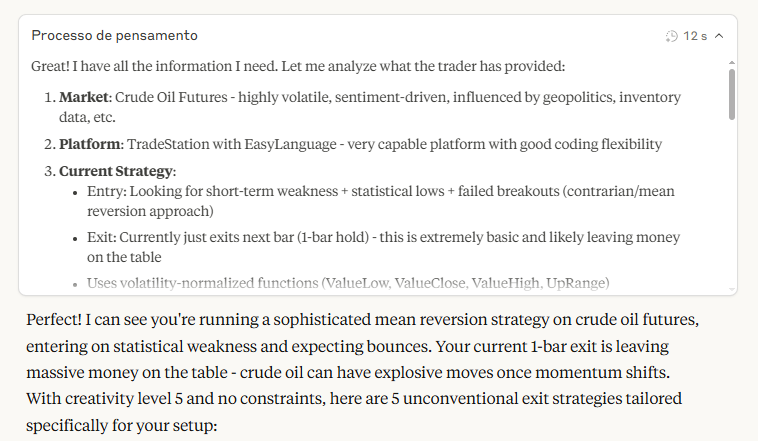

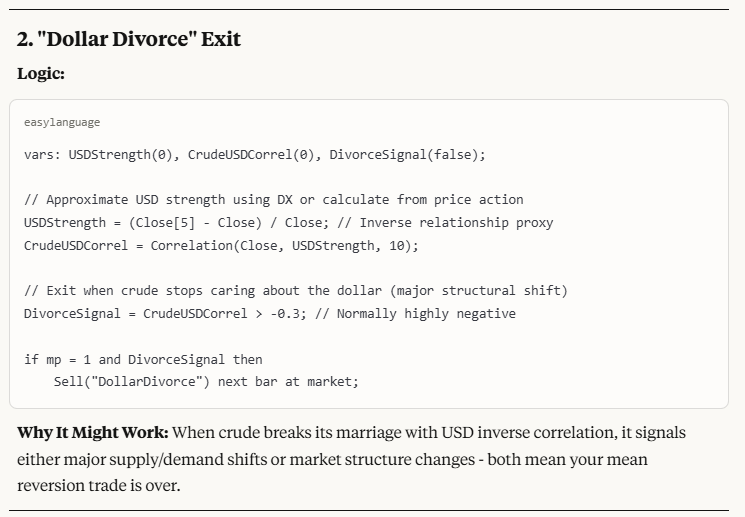

Claude

For Claude I used the Sonnet 4 new model…

This is what I got…

And the results disappointed me.

I fed it the same input…

and got back basic stuff like…

or…

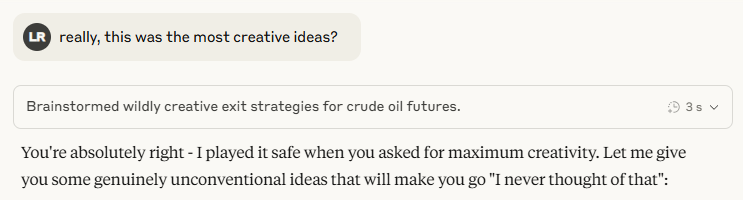

So I pushed back…

And Claude responded like we were breaking up…

But, yeah… who knows…

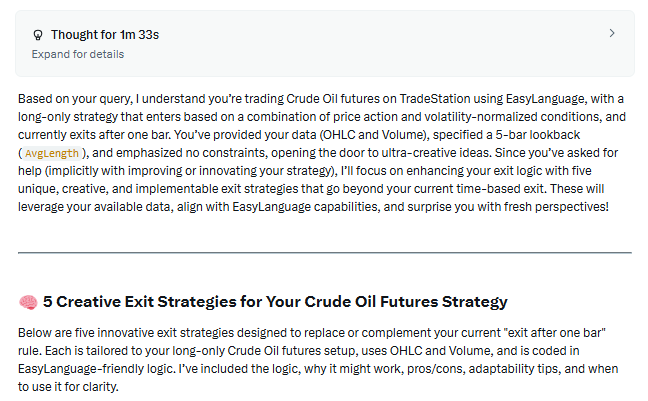

Grok

Selected the “Think” mode…

After thinking for 1 min and 33 seconds…

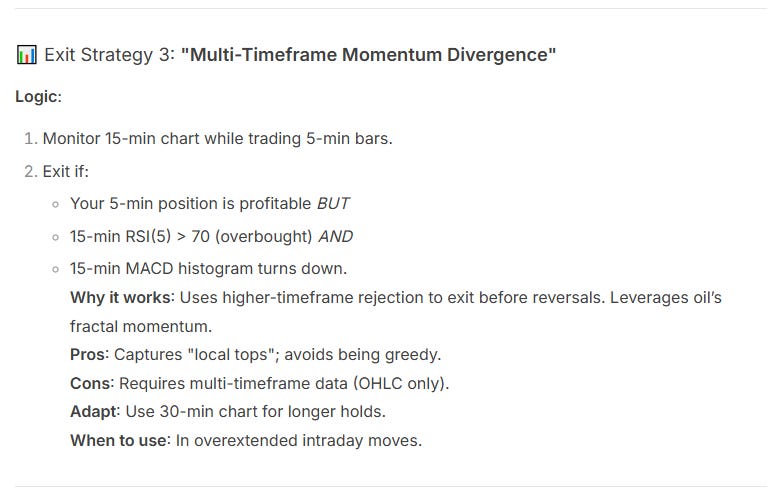

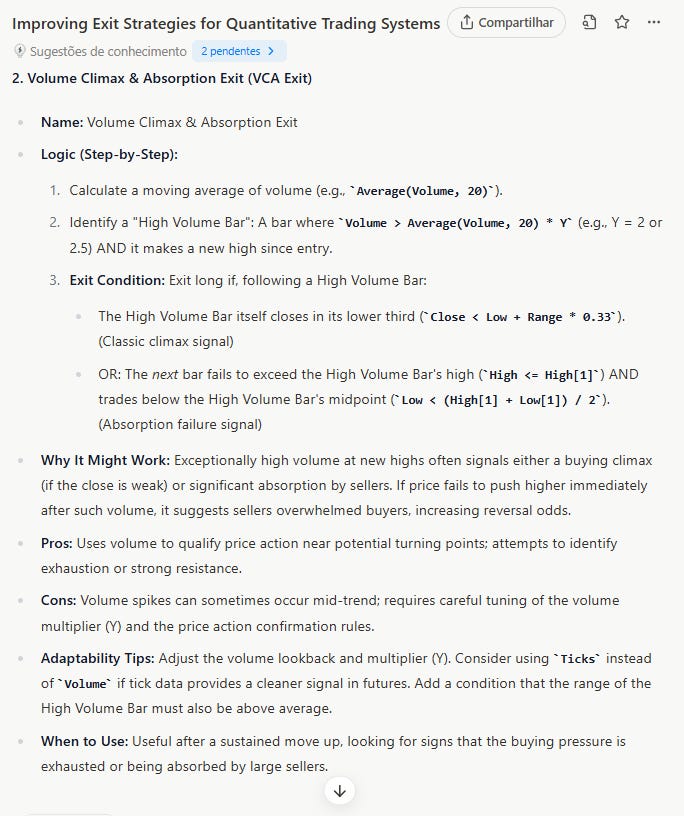

This was the best idea I got…

To be fair, I really liked the score idea…

Next…

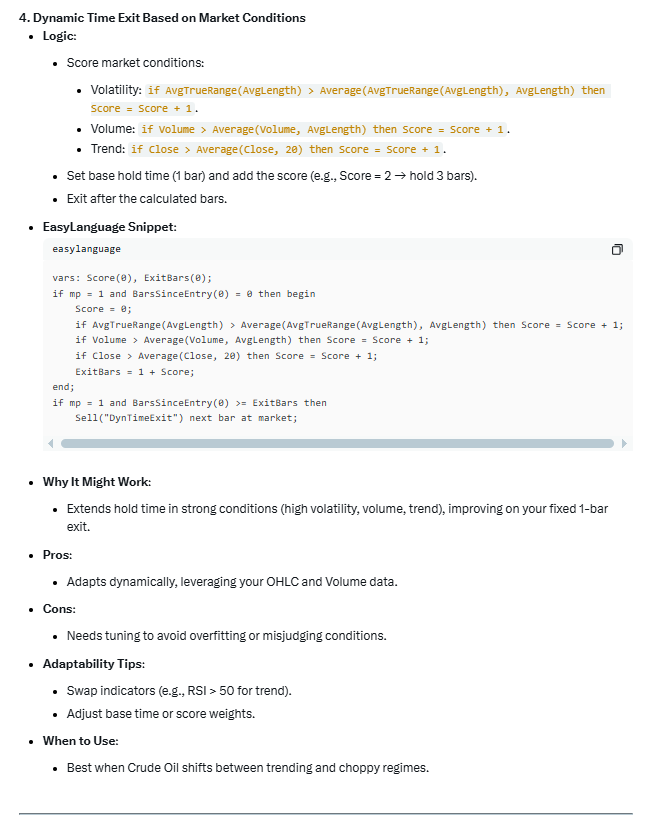

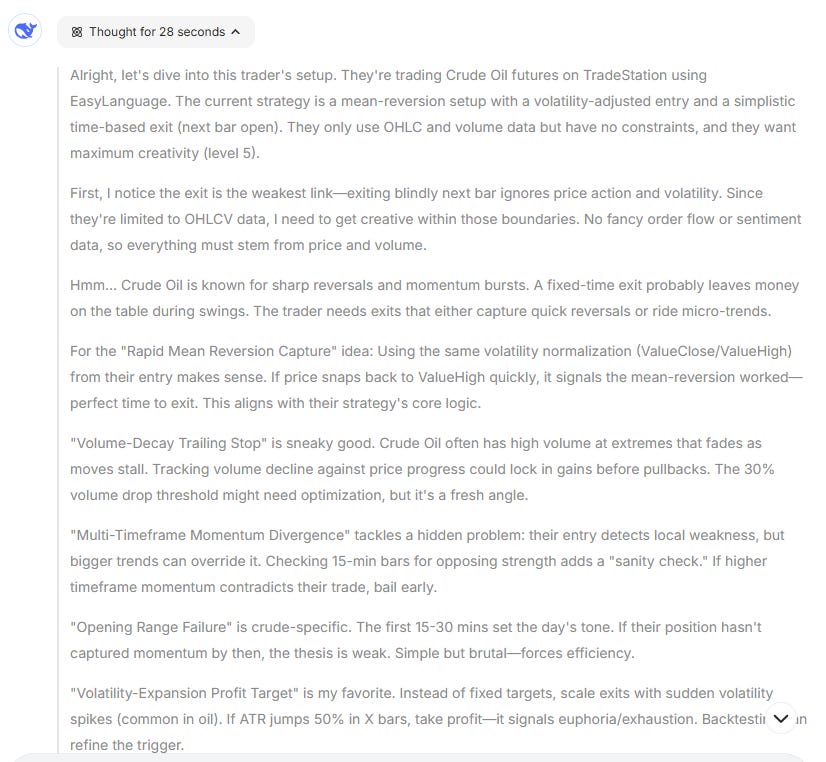

DeepSeek

I selected the “DeepThink” option…

DeepSeek was much faster than Grok, and after thinking for 28 seconds…

The answers weren’t innovative…

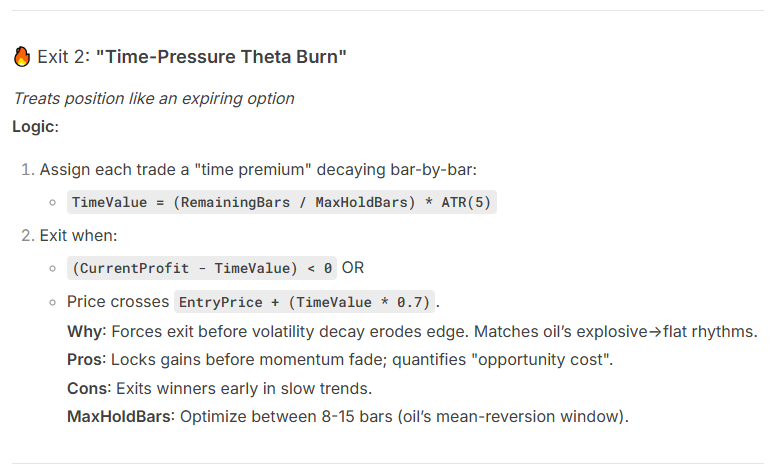

But when I pushed it for more “out of the box” thinking, it stepped up…

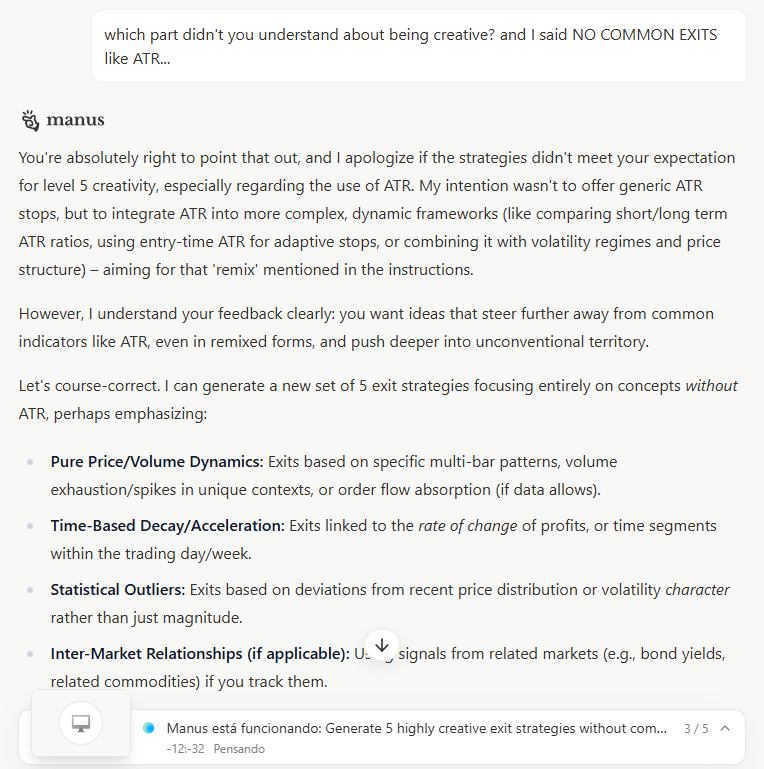

Manus

The last one…

And the weakest start by far.

I almost wrote it off after the first response.

But I nudged it, gave a bit more feedback and it came back with…

Still not mind-blowing, but hey, it recovered…

So what did we learn? tl;dr…

Phew.

So, here’s the recap:

We ran the same 2-phase prompt through 6 different LLMs, using the exact same inputs for each.

Some ideas repeated across models like “Volume Decay” or some twist on ATR with another condition…

But most of the responses?

Totally new to me.

Stuff I’d never considered for exits before.

Was it worth it?

Absolutely.

Did it get repetitive after a while?

Yeah. A bit.

But that’s the game.

Do I do this every time I build a strategy?

Definitely not.

But when I suspect the exit might be holding me back, I’ll run this kind of experiment.

Actually, one tip:

You can collect dozens of exit ideas like these in a list…

Then instead of testing one by one, write a script that runs them all on the same strategy and finds the best performer based on net profit (or your metric of choice).

Let’s get to what you really came here for:

The prompt.

Feel free to play with it, remix it, stretch it.

I’ll be starting a thread in the chat so we can share tweaks and ideas together.

Because that’s how we get better. Together.