How to Build a Real Trading Portfolio on a Small Account

Starting with a 2.6 Profit Factor Strategy (Code Included)...

A subscriber asked me:

“Leo, I only have $5,000. Is it even worth trying to build automated strategies?”

Fair question.

Most traders assume you need a six-figure account, dozens of screens, and an army of indicators to start system trading.

You don’t.

Take Corn futures, for instance.

You only need $108 of margin to trade it on TradeStation.

That means with way less than $5,000, you could test, trade, and run 4–5 strategies simultaneously, each operating on a micro contract.

What I call “the micro-portfolio approach”

Here’s what we’ll cover today:

The small-capital edge: why $5k is more than enough + a quick tour of low-margin markets you can use

Build your micro-portfolio: how to assemble 4–5 uncorrelated systems (risk, validation, execution checklist)

The Corn blueprint (high level): the simple logic behind the example strategy—and why it travels well

Let’s dig in.

1. The Small-Capital Edge

Most traders think small accounts are a disadvantage.

That’s not true and I’ll explain you why but first…

Take a look at the margin requirements for some of the smallest futures on TradeStation:

Four different asset classes and all tradable with less than $700 per contract.

You can access almost every major market using micro contracts.

Let’s see more examples:

Grains & Agriculture:

Micro Corn (MZC): $108 margin

Micro Wheat (MZW): $182 margin

Micro Soybeans (MZS): $220 margin

Energy:

Micro Crude Oil (MCL): $172.50 margin (intraday)

Micro Natural Gas (MNG): $192 margin (intraday)

Micro RBOB Gasoline (MRB): $187.25 margin (intraday)

Currencies:

E-micro EUR/USD (M6E): $319 margin

E-micro GBP/USD (M6B): $220 margin

E-micro AUD/USD (M6A): $242 margin

Interest Rates

Micro Ultra 10-Year Treasury (MTN): $281 margin

10-Year Yield Futures (10Y): $330 margin

2-Year Yield Futures (2YY): $363 margin

Equities:

E-micro Russell 2000 (M2K): $253.25 margin

Micro DAX (FEBD): €246.80 margin

Crypto:

Micro Ether (MET): $165 margin

See?

All with margins under $400.

And that’s the overnight margin, the intraday margin is even lower…

That’s the small-capital edge.

Let me show you what this looks like in practice…

Scenario A: Traditional Approach

Capital: $5,000

Instrument: Mini ES futures

Margin: $2,301

Result: Trade 1 contract and pray.

Scenario B: Micro-Portfolio Approach

Capital: $5,000

Strategy 1: Micro Corn mean-reversion ($108 margin)

Strategy 2: Micro Crude range system ($172.50 margin)

Strategy 3: E-micro EUR/USD breakout ($319 margin)

Strategy 4: Micro Russell 2000 trend ($253.25 margin)

Strategy 5: Micro Wheat counter-trend ($182 margin)

Result: 5 strategies running. Diversified across grains, energy, currencies, and equities.

Same $5,000.

Completely different outcome.

2. Build Your Micro-Portfolio

Okay, so you know you can trade low-margin instruments.

But how do you actually build a portfolio that makes sense?

Here’s the framework I use.

Step 1: Pick Uncorrelated Markets

The worst thing you can do is run 5 strategies on the same instrument.

From my experience is way more difficult to find an edge on uncorrelated strategies on the same instrument than using the ‘same’ core idea (i.e. breakouts) on different markets.

For example:

Energy vs. Grains: Oil and Corn don’t move together

Currencies vs. Equities: EUR/USD and Russell 2000 have different drivers

Rates vs. Everything: Treasury yields respond to different macro forces

Example Portfolio Structure:

Grains: Micro Corn (agricultural fundamentals)

Energy: Micro Crude (geopolitical events, supply/demand)

Currencies: E-micro EUR/USD (central bank policy, macro trends)

Equities: Micro Russell 2000 (economic growth, earnings)

Rates: 10-Year Yield (inflation expectations, Fed policy)

Five different markets.

Five different fundamental drivers.

Five uncorrelated systems.

Step 2: Vary Your Strategy Logic

Even if you pick different markets, you can still get correlation if all your strategies use the same logic.

Bad example:

Strategy 1: Corn mean-reversion (buy oversold, sell overbought)

Strategy 2: Crude mean-reversion (buy oversold, sell overbought)

Strategy 3: EUR/USD mean-reversion (buy oversold, sell overbought)

All three strategies will struggle in trending markets.

Better example:

Strategy 1: Corn mean-reversion (counter-trend)

Strategy 2: Crude breakout (trend-following)

Strategy 3: EUR/USD range trading (sideways markets)

Strategy 4: Russell 2000 momentum (strong trends)

Strategy 5: Wheat opening range breakout (first-hour edge)

Now you’re diversified by both market and market condition.

Step 3: Risk Allocation

Here’s where most traders screw up.

They allocate capital evenly: $1,000 per strategy, done.

But not all strategies have the same risk profile.

A smarter approach…

Allocate based on maximum expected drawdown.

If a strategy historically has a drawdown of 15%, you need buffer room for that.

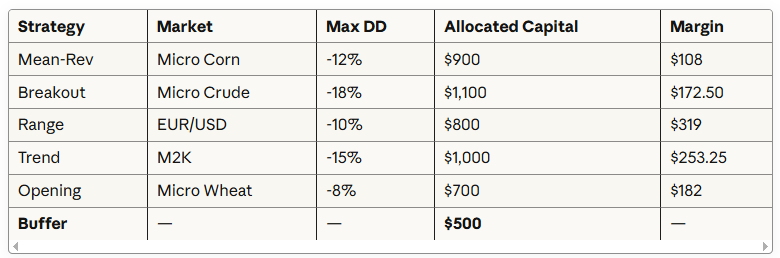

Example allocation for $5,000:

Notice the buffer?

That’s your “Houston we have a problem” money for when multiple strategies hit drawdowns simultaneously.

Always keep 10-15% in cash.

Step 4: Validation Checklist

Before you deploy any strategy in your micro-portfolio, make sure you run through this:

Backtest over at least 10 years of data

Walk-forward test on out-of-sample data

Verify the logic makes intuitive sense

Check correlation with your other strategies (ideally <0.3) You can do this on excel or ask AI for a python script

Confirm margin requirements fit your capital

Verify liquidity (can you actually get filled?) because some micro instruments lacks liquidity

If any box doesn’t check, don’t add it to your portfolio.

Step 5: Execution Checklist

You’ve built your portfolio.

You’ve validated each strategy.

Now what?

Before going live:

Paper trade for 3 months minimum (to catch execution bugs and compare backtesting with live trading results)

Start with 1 contract per strategy (no matter how confident you are)

Set calendar reminders to review (monthly is fine)

Track correlation in real-time (are your strategies still uncorrelated?)

Have a kill switch ready (pre-define a kill-switch rule. For example, shut down a strategy if live returns deviate more than 2 standard deviations from backtest performance.)

Most importantly:

Track everything and…

Let them breathe.

System trading requires patience.

3. Your Next Micro Strategy

Let’s put all of this into practice.

To show how the micro-portfolio approach works in the real world, I started with Corn Futures (ZC) which is one of the cheapest contracts on the CME.

The setup is simple:

A volatility expansion strategy that waits for volatility to spike and rides the follow-through in the direction of the trend.

The Logic (Plain English)

Measure volatility over the past X days.

When today’s range explodes to more than 2× that average (plus a standard deviation kicker)...

Check direction:

If price is above the X-bar trend line → go long.

If price is below → short.

Exit after Y bars (roughly a few weeks on a daily chart).

Apply a profit target and a stop loss.

That’s it.

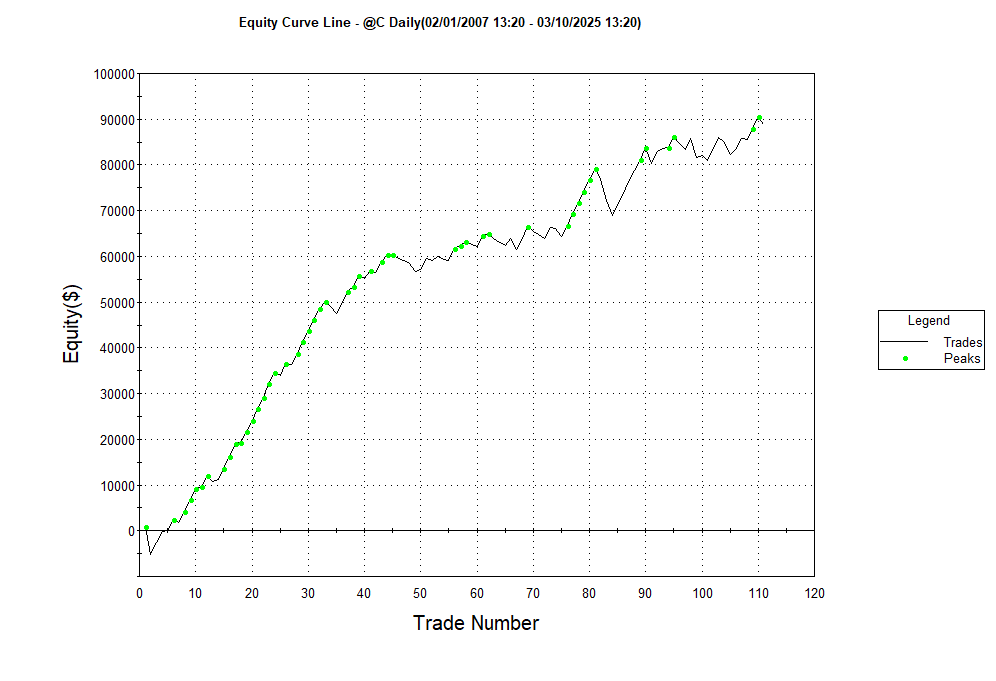

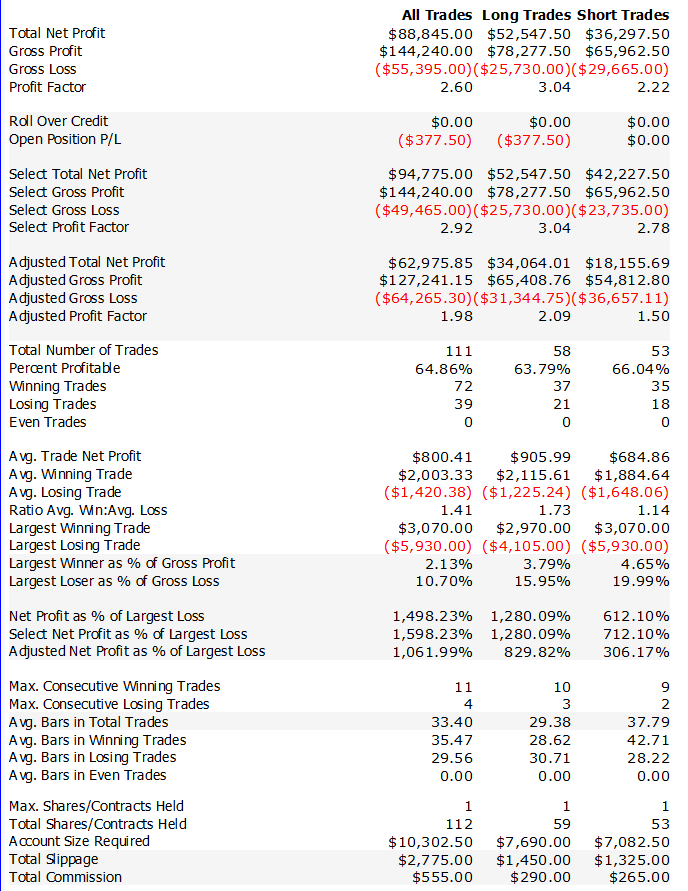

Here’s what you get…

Why It Travels Well

The real edge isn’t in the market…

It’s in the logic.

This framework works across several commodities

You just adjust the volatility lookback and risk parameters.

That’s what makes it a perfect first building block for your micro-portfolio:

Simple logic

Easy to automate

Easy to replicate across markets

Now let’s dive in into the code…